Taking out a mortgage to attend school is an funding in your future. However not like in the USA, college students in Pakistan don’t have easy accessibility to varsity loans. As an alternative, most households should abdomen increased rates of interest for private loans that may require collateral like land or houses. Because of this, school is inaccessible for a lot of college students. It’s one purpose why solely about 13 percent of Pakistani college students attend school.

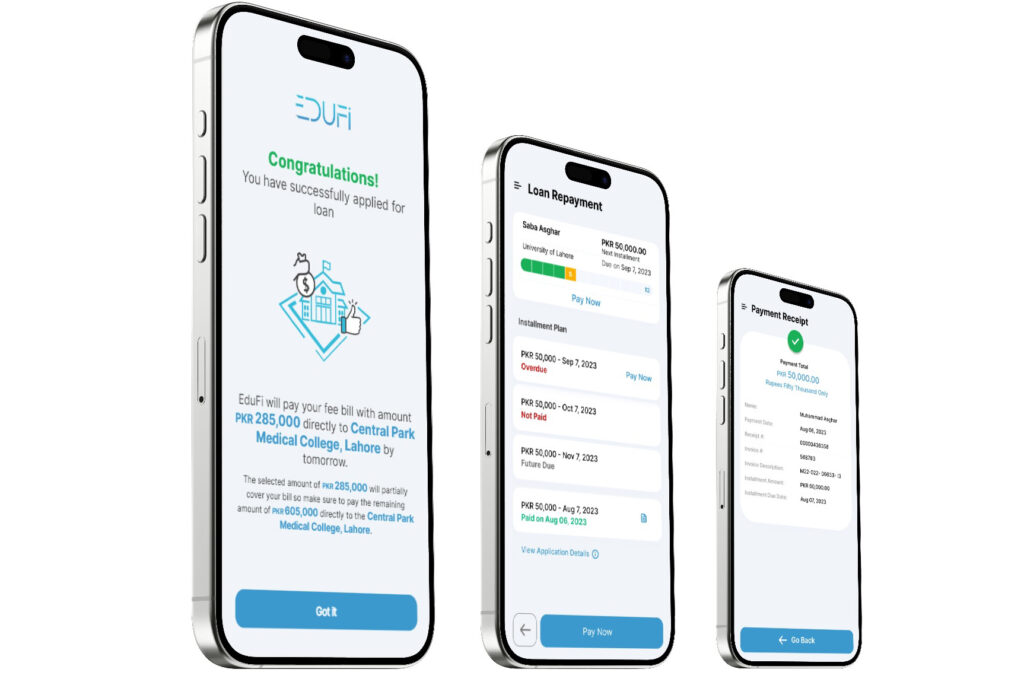

Now EduFi, based by Aleena Nadeem ’16, is providing low-interest pupil loans to a broader swath of Pakistanis. EduFi, which is brief for “training finance,” makes use of a synthetic intelligence-based credit score scoring system to qualify debtors and pay schools straight. The debtors then make month-to-month funds to EduFi together with a service payment of 1.4 p.c — far decrease than what is obtainable for many college students at this time.

“The charges for faculty are extraordinarily unaffordable for the common middle-class particular person proper now,” Nadeem explains. “With our ‘Research Now, Pay Later’ system, we’re breaking that large upfront price into installments, which makes it extra inexpensive for each present school college students and a brand new group of folks that by no means thought increased training was potential.”

EduFi was included in 2021, and after gaining regulatory approval, the corporate started disbursing loans to folks throughout Pakistan final 12 months. Within the first six months, EduFi disbursed greater than half one million {dollars} in loans. Since then, the corporate’s inclusive method to qualifying candidates has been validated: Immediately, lower than 1 in 10,000 of these loans aren’t being repaid.

As consciousness about EduFi grows, Nadeem believes the corporate can contribute to Pakistan’s modernization and growth extra broadly.

“We’re accepting so many extra folks that will not have been in a position to get a financial institution mortgage,” Nadeem says. “That will get extra folks to go to varsity. The influence of directing low-cost and quick credit score to the academic sector on a creating nation like Pakistan is large.”

Higher credit score

On the British worldwide highschool Nadeem attended, nobody had ever gotten into an Ivy League faculty. That made her acceptance into MIT a giant deal.

“It was my first alternative by far,” Nadeem says.

When she arrived on campus, Nadeem took courses at MIT that taught her about auctions, threat, and credit score.

“Within the work I’m doing with EduFi now, I’m making use of what I realized in my courses in the true world,” Nadeem says.

Nadeem labored within the credit score division at Goldman Sachs in London after commencement, however boundaries to accessing increased training in her house nation nonetheless bothered her.

In Pakistan, some focused applications supply monetary help for college students with exceptionally excessive grades who can’t afford school, however the overwhelming majority of households should discover different methods to finance school.

“Most college students and their households should get private loans from normal banks, however that requires them to open a checking account, which may take two months,” Nadeem explains. “Charges in Pakistan’s training sector should be paid quickly after the requests are despatched, and by the point banks settle for or reject you, the cost may already be late.”

Non-public loans in Pakistan include a lot increased rates of interest than pupil loans in America. Many loans additionally require debtors to place up property as collateral. These challenges stop many promising college students from attending school in any respect.

EduFi is utilizing expertise to enhance the mortgage qualification course of. In Pakistan, the guardian is the first borrower. EduFi has developed an algorithmic credit score scoring system that considers the borrower’s monetary historical past then makes funds on to the school on their behalf. EduFi additionally works straight with schools to contemplate the scholars’ grades and cost historical past to the varsity.

Debtors pay again the mortgage in month-to-month installments with a 1.4 p.c service payment. No collateral is required.

“We’re the primary movers in pupil lending and at present maintain the biggest pupil mortgage portfolio within the nation,” Nadeem says. “We’re providing extraordinarily backed charges to lots of people. Our charges are means cheaper than the financial institution options. We nonetheless make a revenue, however we’re impact-focused, so we make revenue by means of disbursing to a bigger variety of folks reasonably than growing the margin per particular person.”

Nadeem says EduFi’s method qualifies much more folks for loans in comparison with banks and does so 5 instances sooner. That makes school extra accessible for college students throughout Pakistan.

“Banks cost excessive rates of interest to the folks with one of the best credit score scores,” Nadeem says. “By not taking collateral, we actually open up the credit score house to new individuals who wouldn’t have been in a position to get a financial institution mortgage. Simpler credit score offers the common middle-class particular person the power to vary their households’ lives.”

Serving to international locations by serving to folks

EduFi acquired its non-banking monetary license in February 2024. The corporate gained early traction final 12 months by means of phrase of mouth and shortly opened to debtors throughout the nation. Since then, Nadeem says many individuals have traveled lengthy distances to EduFi’s headquarters to substantiate they’re a reputable operation. Nadeem additionally repeatedly receives messages from college students throughout Pakistan thanking EduFi for serving to them attend school.

After additional proving out its mannequin this 12 months, EduFi plans to increase to Saudi Arabia. Ultimately, it plans to supply its loans to college students all through the Center East, and Nadeem believes the worldwide pupil mortgage system might be improved utilizing EduFi’s method.

“EduFi is modeled after SoFi in San Francisco,” Nadeem says of the big finance firm that began by providing pupil loans and expanded to mortgages, bank cards, and different banking providers. “I’m making an attempt to construct the SoFi of Pakistan and the Center East. But it surely’s actually a mixture of SoFi and Grameen Financial institution [in Bangladesh], which extends credit score to lower-income folks to elevate them out of poverty.”

By serving to folks lengthen their training and attain their full potential, Nadeem believes EduFi will sooner or later speed up the event of whole nations.

“Schooling is the core pillar from which a rustic stands,” Nadeem says. “You may’t progress as a rustic with out making training as accessible and inexpensive as potential. EduFi is attaining that by directing capital at what’s frankly a ravenous training sector.”