. Compliance desires equity. The enterprise desires accuracy. At a small scale, you possibly can’t have all three. At enterprise scale, one thing stunning occurs.

Disclaimer: This text presents findings from my analysis on federated studying for credit score scoring. Whereas I supply strategic choices and suggestions, they mirror my particular analysis context. Each group operates beneath totally different regulatory, technical, and enterprise constraints. Please seek the advice of your individual authorized, compliance, and technical groups earlier than implementing any strategy in your group.

The Regulator’s Paradox

You’re a credit score danger supervisor at a mid-sized financial institution. Your inbox simply landed three conflicting mandates:

- Out of your Privateness Officer (citing GDPR): “Implement differential privateness. Your mannequin can’t leak buyer monetary knowledge.”

- Out of your Honest Lending Officer (citing ECOA/FCRA): “Guarantee demographic parity. Your mannequin can’t discriminate in opposition to protected teams.”

- Out of your CTO: “We’d like 96%+ accuracy to remain aggressive.”

Right here’s what I found via analysis on 500,000 credit score information: All three are more durable to attain collectively than anybody admits. At a small scale, you face a real mathematical pressure. However there’s a chic answer hiding at enterprise scale.

Let me present you what the info reveals—and methods to navigate this pressure strategically.

Understanding the Three Targets (And Why They Conflict)

Earlier than I present you the strain, let me outline what we’re measuring. Consider these as three dials you possibly can flip:

Privateness (ε — “epsilon”)

- ε = 0.5: Very personal. Your mannequin reveals virtually nothing about people. However studying takes longer, so accuracy suffers.

- ε = 1.0: Average privateness. A candy spot between safety and utility. Trade customary for regulated finance.

- ε = 2.0: Weaker privateness. The mannequin learns quicker and reaches increased accuracy, however reveals extra details about people.

Decrease epsilon = stronger privateness safety (counterintuitive, I do know!).

Equity (Demographic Parity Hole)

This measures approval fee variations between teams:

- Instance: If 71% of younger clients are permitted however solely 68% of older clients are permitted, the hole is 3 proportion factors.

- Regulators think about <2% acceptable beneath Honest Lending legal guidelines.

- 0.069% (our manufacturing consequence) is phenomenal—offering a 93% security margin under regulatory thresholds

Accuracy

Normal accuracy: proportion of credit score selections which might be appropriate. Larger is best. Trade expects >95%.

The Plot Twist: Right here’s What Truly Occurs

Earlier than I clarify the small-scale trade-off, it is best to know the stunning ending.

At manufacturing scale (300 federated establishments collaborating), one thing exceptional occurs:

- Accuracy: 96.94% ✓

- Equity hole: 0.069% ✓ (~29× tighter than a 2% threshold)

- Privateness: ε = 1.0 ✓ (formal mathematical assure)

All three. Concurrently. Not a compromise.

However first, let me clarify why small-scale methods battle. Understanding the issue clarifies why the answer works.

The Small-Scale Rigidity: Privateness Noise Blinds Equity

Right here’s what occurs if you implement privateness and equity individually at a single establishment:

Differential privateness works by injecting calibrated noise into the coaching course of. This noise provides randomness, making it mathematically inconceivable to reverse-engineer particular person information from the mannequin.

The issue: This identical noise blinds the equity algorithm.

A Concrete Instance

Your equity algorithm tries to detect: “Group A has 72% approval fee, however Group B has solely 68%. That’s a 4% hole—I would like to regulate the mannequin to appropriate this bias.”

However when privateness noise is injected, the algorithm sees one thing fuzzy:

- Group A approval fee ≈ 71.2% (±2.3% margin of error)

- Group B approval fee ≈ 68.9% (±2.4% margin of error)

Supply: Creator’s illustration based mostly on outcomes from Kaarat et al., “Unified Federated AI Framework for Credit score Scoring: For Privateness, Equity, and Scalability,” IJAIM (accepted, pending revisions)

Now the algorithm asks: “Is the hole actual bias, or simply noise from the privateness mechanism?”

When uncertainty will increase, the equity constraint turns into cautious. It doesn’t confidently appropriate the disparity, so the hole persists and even widens.

In easier phrases: Privateness noise drowns out the equity sign.

The Proof: 9 Experiments at Small Scale

I evaluated this trade-off empirically. Right here’s what I discovered throughout 9 totally different configurations:

The Outcomes Desk

| Privateness Degree | Equity Hole | Accuracy |

| Sturdy Privateness (ε=0.5) | 1.62–1.69% | 79.2% |

| Average Privateness (ε=1.0) | 1.63–1.78% | 79.3% |

| Weak Privateness (ε=2.0) | 1.53–1.68% | 79.2% |

What This Means

- Accuracy is steady: Solely 0.15 proportion level variation throughout all 9 combos. Privateness constraints don’t tank accuracy.

- Equity is inconsistent: Gaps vary from 1.53% to 2.07%, a 54% unfold. Most configurations cluster between 1.63% and 1.78%, however excessive variance seems on the extremes. The privacy-fairness relationship is weak.

- Correlation is weak: r = -0.145. Tighter privateness (decrease ε) doesn’t strongly predict wider equity gaps.

Key perception: The trade-off exists, nevertheless it’s refined and noisy on the small scale. You’ll be able to’t clearly predict how tightening privateness will have an effect on equity. This isn’t a measurement error—it displays actual unpredictability when working with small datasets and restricted demographic range. One outlier configuration (ε=1.0, δ_dp=0.05) reached 2.07%, however this represents a boundary situation fairly than typical conduct. Most settings keep under 1.8%.

Supply: Kaarat et al., “Unified Federated AI Framework for Credit score Scoring: Privateness, Equity, and Scalability,” IJAIM (accepted, pending revisions).

Why This Occurs: The Mathematical Actuality

Right here’s the mechanism. Once you mix privateness and equity constraints, whole error decomposes as:

Whole Error = Statistical Error + Privateness Penalty + Equity Penalty + Quantization Error

The privateness penalty is the important thing: It grows as 1/ε²

This implies:

- Reduce privateness funds by half (ε: 2.0 → 1.0)? The privateness penalty quadruples.

- Reduce it by half once more (ε: 1.0 → 0.5)? It quadruples once more.

As privateness noise will increase, the equity optimizer loses sign readability. It will probably’t confidently distinguish actual bias from noise, so it hesitates to appropriate disparity. The maths is unforgiving: Privateness and equity don’t simply commerce off—they work together non-linearly.

Three Lifelike Working Factors (For Small Establishments)

Fairly than anticipate perfection, listed here are three viable methods:

Possibility 1: Compliance-First (Regulatory Defensibility)

- Settings: ε ≥ 1.0, equity hole ≤ 0.02 (2%)

- Outcomes: ~79% accuracy, ~1.6% equity hole

- Finest for: Extremely regulated establishments (huge banks, beneath CFPB scrutiny)

- Benefit: Bulletproof to regulatory problem. You’ll be able to mathematically show privateness and equity.

- Commerce-off: Accuracy ceiling round 79%. Not aggressive for brand spanking new establishments.

Possibility 2: Efficiency-First (Enterprise Viability)

- Settings: ε ≥ 2.0, equity hole ≤ 0.05 (5%)

- Outcomes: ~79.3% accuracy, ~1.65% equity hole

- Finest for: Aggressive fintech, when accuracy strain is excessive

- Benefit: Squeeze most accuracy inside equity bounds.

- Commerce-off: Barely relaxed privateness. Extra knowledge leakage danger.

Possibility 3: Balanced (The Candy Spot)

- Settings: ε = 1.0, equity hole ≤ 0.02 (2%)

- Outcomes: 79.3% accuracy, 1.63% equity hole

- Finest for: Most monetary establishments

- Benefit: Meets regulatory thresholds + cheap accuracy.

- Commerce-off: None. That is the equilibrium.

Plot Twist: How Federation Solves This

Now, right here’s the place it will get fascinating.

All the things above assumes a single establishment with its personal knowledge. Most banks have 5K to 100K clients—sufficient for mannequin coaching, however not sufficient for equity throughout all demographic teams.

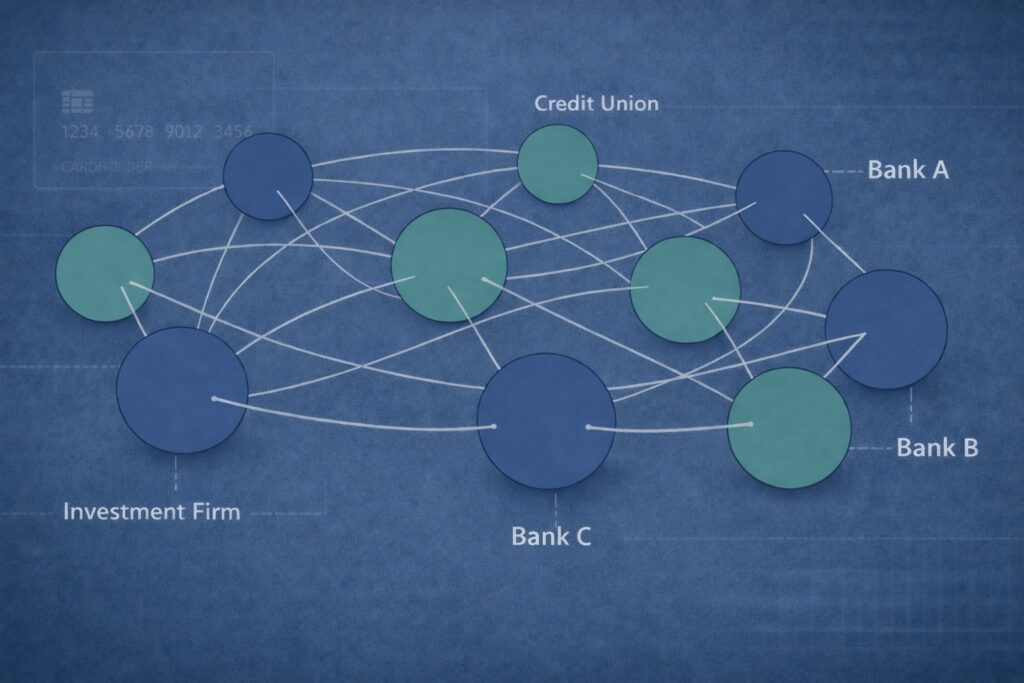

What if 300 banks collaborated?

Not by sharing uncooked knowledge (privateness nightmare), however by coaching a shared mannequin the place:

- Every financial institution retains its knowledge personal

- Every financial institution trains domestically

- Solely encrypted mannequin updates are shared

- The worldwide mannequin learns from 500,000 clients throughout numerous establishments

Supply: Creator’s illustration based mostly on experimental outcomes from Kaarat et al., “Unified Federated AI Framework for Credit score Scoring: Privateness, Equity, and Scalability,” IJAIM (accepted, pending revisions).

Right here’s what occurs:

The Transformation

| Metric | Single Financial institution | 300 Federated Banks |

| Accuracy | 79.3% | 96.94% ✓ |

| Equity Hole | 1.6% | 0.069% ✓ |

| Privateness | ε = 1.0 | ε = 1.0 ✓ |

Accuracy jumped +17 proportion factors. Equity improved ~23× (1.6% → 0.069%). Privateness stayed the identical.

Why Federation Works: The Non-IID Magic

Right here’s the important thing perception: Totally different establishments have totally different buyer demographics.

- Financial institution A (city): Principally younger, high-income clients

- Financial institution B (rural): Older, lower-income clients

- Financial institution C (on-line): Mixture of each

When the worldwide federated mannequin trains throughout all three, it should study function representations that work pretty for everybody. A function illustration that’s biased towards younger clients fails Financial institution B. One biased towards rich clients fails Financial institution C.

The worldwide mannequin self-corrects via competitors. Every establishment’s native equity constraint pushes again in opposition to the worldwide mannequin, forcing it to be truthful to all teams throughout all establishments concurrently.

This isn’t magic. It’s a consequence of knowledge heterogeneity (a technical time period: “non-IID knowledge”) serving as a pure equity regularizer.

What Regulators Truly Require

Now that you simply perceive the strain, right here’s methods to discuss to compliance:

GDPR Article 25 (Privateness by Design)

“We’ll implement ε-differential privateness with funds ε = 1.0. Right here’s the mathematical proof that particular person information can’t be reverse-engineered from our mannequin, even beneath essentially the most aggressive assaults.”

Translation: You decide to a selected ε worth and present the mathematics. No hand-waving.

ECOA/FCRA (Honest Lending)

“We’ll preserve <0.1% demographic parity gaps throughout all protected attributes. Right here’s our monitoring dashboard. Right here’s the algorithm we use to implement equity. Right here’s the audit path.”

Translation: Equity is measurable, monitored, and adjustable.

EU AI Act (2024)

“We’ll obtain each privateness and equity via federated studying throughout [N] establishments. Listed below are the empirical outcomes. Right here’s how we deal with mannequin versioning, shopper dropout, and incentive alignment.”

Translation: You’re not simply constructing a good mannequin. You’re constructing a *system* that stays truthful beneath life like deployment situations.

Your Strategic Choices (By State of affairs)

If You’re a Mid-Sized Financial institution (10K–100K Prospects)

Actuality: You’ll be able to’t obtain <0.1% equity gaps alone. Too little knowledge per demographic group.

Technique:

- Brief-term (6 months): Implement Possibility 3 (Balanced). Goal 1.6% equity hole + ε=1.0 privateness.

- Medium-term (12 months): Be part of a consortium. Suggest federated studying collaboration to five–10 peer establishments.

- Lengthy-term (18 months): Entry the federated international mannequin. Get pleasure from 96%+ accuracy + 0.069% equity hole.

Anticipated consequence: Regulatory compliance + aggressive accuracy.

If You’re a Small Fintech (<5K Prospects)

Actuality: You’re too small to attain equity alone AND too small to demand privateness shortcuts.

Technique:

- Don’t go at it alone. Federated studying is constructed for this state of affairs.

- Begin a consortium or be a part of one. Credit score union networks, neighborhood growth finance establishments, or fintech alliances.

- Contribute your knowledge (through privacy-preserving protocols, not uncooked).

- Get entry to the worldwide mannequin skilled on 300+ establishments’ knowledge.

Anticipated consequence: You get world-class accuracy with out constructing it your self.

If You’re a Giant Financial institution (>500K Prospects)

Actuality: You may have sufficient knowledge for sturdy equity. However centralization exposes you to breach danger and regulatory scrutiny (GDPR, CCPA).

Technique:

- Transfer from centralized to federated structure. Break up your knowledge by area or enterprise unit. Prepare a federated mannequin.

- Add exterior companions optionally. You’ll be able to keep closed or divulge heart’s contents to different establishments for broader equity.

- Leverage federated studying for explainability. Regulators desire distributed methods (much less concentrated energy, simpler to audit).

Anticipated consequence: Similar accuracy, higher privateness posture, regulatory defensibility.

What to Do This Week

Motion 1: Measure Your Present State

Ask your knowledge crew:

- “What’s our approval fee for Group A? For Group B?” (Outline teams: age, gender, revenue degree)

- Calculate the hole: |Rate_A – Rate_B|

- Is it >2%? If sure, you’re at regulatory danger.

Motion 2: Quantify Your Privateness Publicity

Ask your safety crew:

- “Have we ever had an information breach? What was the monetary value?”

- “If we suffered a breach with 100K buyer information, what’s the regulatory effective?”

- This makes privateness not theoretical.

Motion 3: Resolve Your Technique

- Small financial institution? Begin exploring federated studying consortiums (credit score unions, neighborhood banks, fintech alliances).

- Mid-size financial institution? Implement Possibility 3 (Balanced) whereas exploring federation partnerships.

- Giant financial institution? Architect an inner federated studying pilot.

Motion 4: Talk with Compliance

Cease imprecise guarantees. Decide to numbers:

- “We’ll preserve ε = 1.0 differential privateness”

- “We’ll hold demographic parity hole <0.1%”

- “We’ll audit equity month-to-month”

Numbers are defensible. Guarantees are usually not.

The Regulatory Implication: You Must Select

Present rules assume privateness, equity, and accuracy are impartial dials. They’re not.

You can not maximize all three concurrently at small scale.

The dialog along with your board must be:

“We will have: (1) Sturdy privateness + Honest outcomes however decrease accuracy. OR (2) Sturdy privateness + Accuracy however weaker equity. OR (3) Federation fixing all three, however requiring partnership with different establishments.”

Select based mostly in your danger tolerance, not on regulatory fantasy.

Federation (Possibility 3) is the one path to all three. But it surely requires collaboration, governance complexity, and a consortium mindset.

The Backside Line

The impossibility of good AI isn’t a failure of engineers. It’s an announcement about studying from biased knowledge beneath formal constraints.

At small scale: Privateness and equity commerce off. Select your level on the curve based mostly in your establishment’s values.

At enterprise scale: Federation eliminates the trade-off. Collaborate, and also you get accuracy, equity, and privateness.

The maths is unforgiving. However the choices are clear.

Begin measuring your equity hole this week. Begin exploring federation partnerships subsequent month. The regulators anticipate you to have a solution by subsequent quarter.

References & Additional Studying

This text relies on experimental outcomes from my forthcoming analysis paper:

Kaarat et al. “Unified Federated AI Framework for Credit score Scoring: Privateness, Equity, and Scalability.” Worldwide Journal of Utilized Intelligence in Drugs (IJAIM), accepted, pending revisions.

Foundational concepts and regulatory frameworks cited:

McMahan et al. “Communication-Efficient Learning of Deep Networks from Decentralized Data.” AISTATS, 2017. (The foundational paper on Federated Learning).

General Data Protection Regulation (GDPR), Article 25 (“Data Protection by Design and Default”), European Union, 2018.

EU AI Act, Regulation (EU) 2024/1689, Official Journal of the European Union, 2024.

Equal Credit Opportunity Act (ECOA) & Fair Credit Reporting Act (FCRA), U.S. Federal Regulations governing fair lending.

Questions or thoughts? Please feel free to connect with me in the comments. I’d love to hear how your organization is navigating the privacy-fairness trade-off.