Accounting work has all the time been tedious. Each day, we spend hours on duties that must be easier. We’re pressured to manually enter information, reconcile transactions, and sift via recordsdata making an attempt to find monetary data we want.

However synthetic intelligence is beginning to change this actuality. Xero, one of many main cloud accounting platforms, has built-in AI options which are streamlining these day by day duties. From their new conversational assistant JAX to automated financial institution reconciliation, these instruments are serving to accountants and enterprise homeowners reclaim time for extra priceless work.

Xero AI: Native options defined

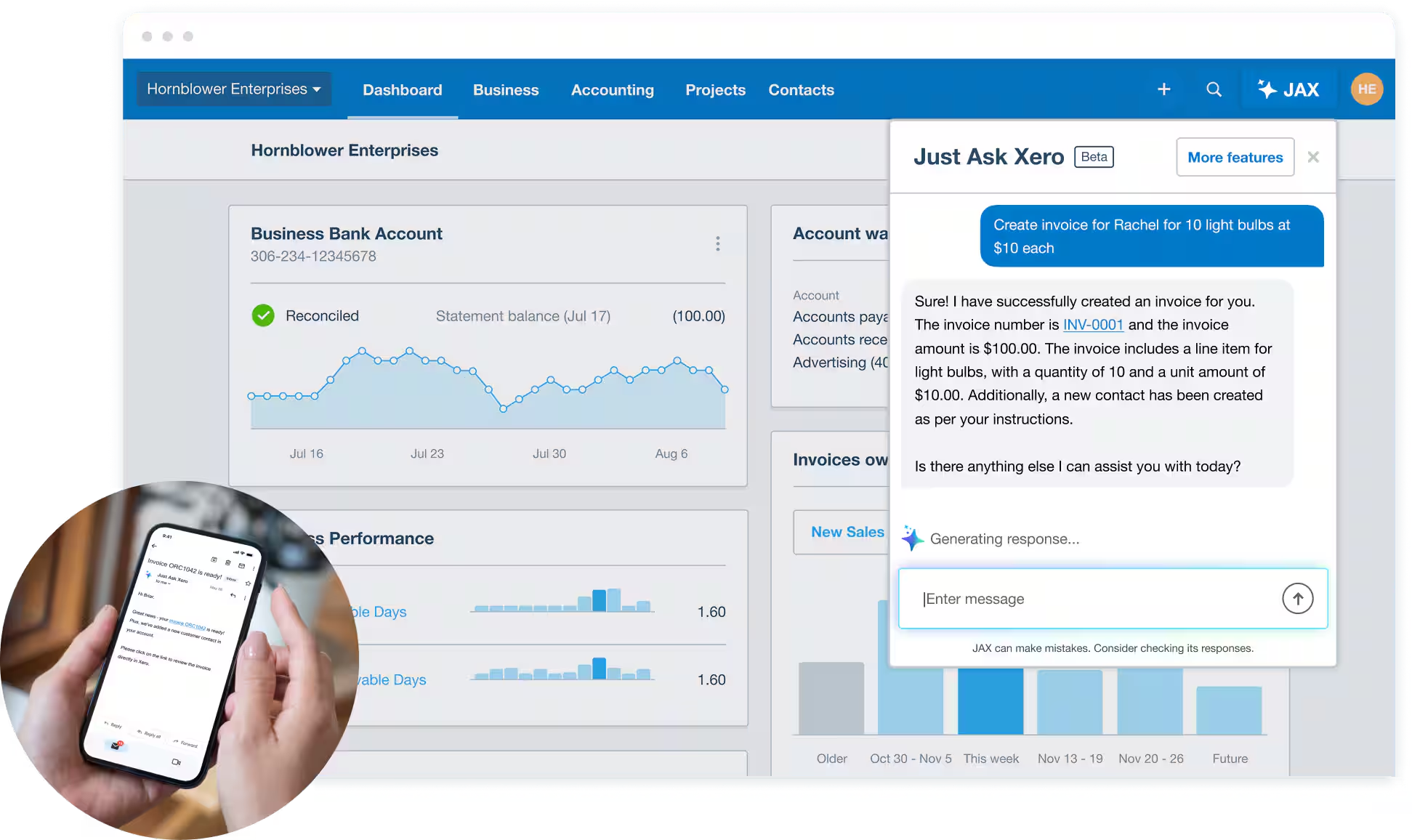

At Xerocon 2024, one important product reveal was an AI assistant named JAX (Simply Ask Xero). It represented an fascinating shift in how we work together with accounting software program. As an alternative of navigating menus and kinds, you possibly can merely message JAX via WhatsApp or e-mail to create invoices, test money move, or deal with payments.

Xero has added a number of AI capabilities that may make a distinction in the way you deal with day by day accounting duties. Let’s break them down.

1. Simply Ask Xero (JAX)

JAX marks Xero’s greatest step into conversational AI. Introduced in February 2024, this AI assistant does extra than simply reply to instructions. It helps you’re employed naturally together with your accounting information. When it is advisable to generate an bill, relatively than opening Xero and navigating via menus, you possibly can merely message JAX via WhatsApp or e-mail together with your request.

The assistant handles core accounting duties like creating invoices, managing quotes, and processing payments. However its actual worth comes from its capacity to assume forward. It suggests follow-up actions, alerts you about potential money move points, or reminds you about pending approvals. As Xero continues to develop JAX’s capabilities, they’re specializing in making accounting workflows extra intuitive and proactive.

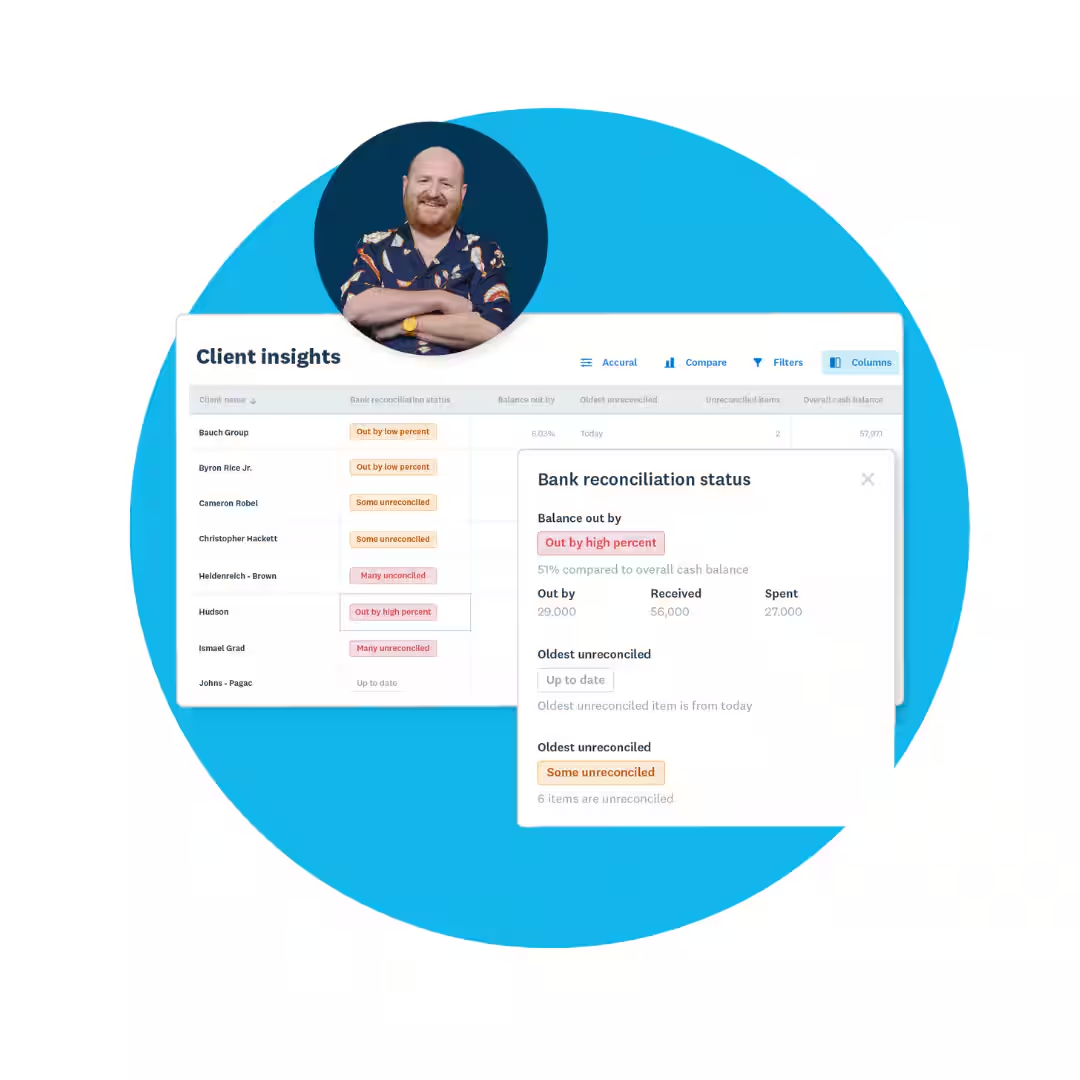

2. AI-powered financial institution reconciliation

This technique learns out of your reconciliation historical past to foretell and counsel matches between financial institution transactions and your accounting information.

Key capabilities embody:

- Studying out of your previous reconciliation patterns to enhance matching accuracy

- Cross-referencing incoming funds in opposition to excellent invoices

- Figuring out and flagging uncommon transactions that do not match typical patterns

- Suggesting transaction classes based mostly on historic information

- Automating recurring transaction matching

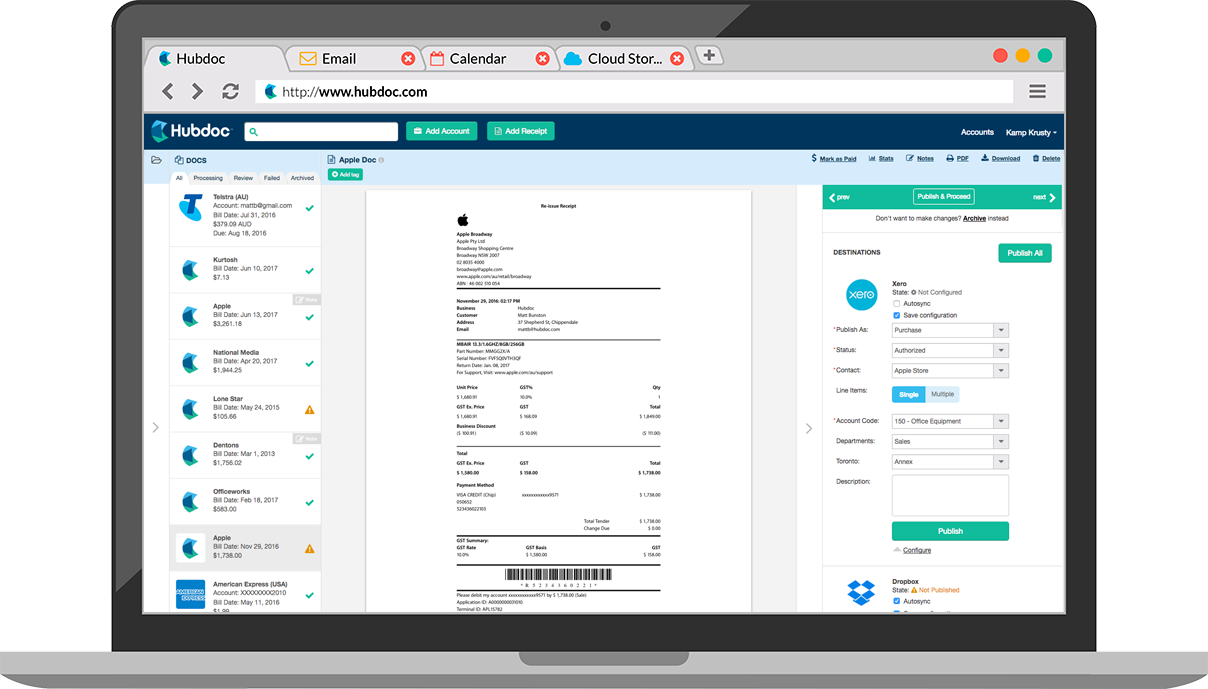

3. Sensible information extraction

Xero’s Hubdoc device can routinely extract transaction information from financial institution statements and receipts and combine it into your accounting information. The system can course of a number of assertion codecs, figuring out key data like dates, quantities, and transaction varieties.

The AI validates extracted information in opposition to present information, flagging any discrepancies that want human consideration. This implies you spend much less time on information entry and extra time on guaranteeing your monetary information are correct.

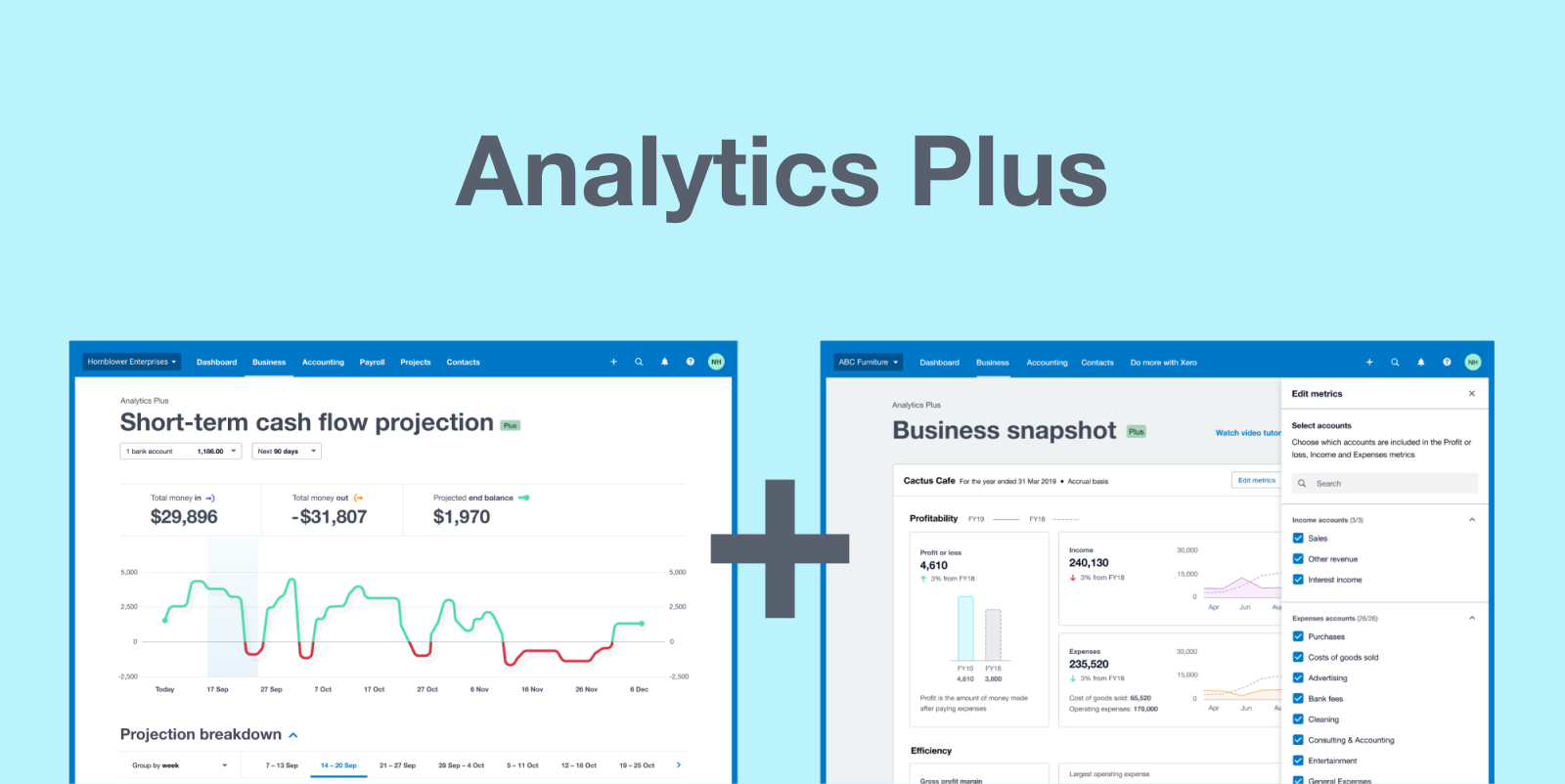

4. Analytics Plus

It brings AI-driven insights to your monetary information. As an alternative of spending hours analyzing spreadsheets, you get automated forecasts based mostly in your precise enterprise information.

Key options embody:

- Money move projections utilizing your actual bill and invoice information

- Quick-term money place monitoring

- Monitoring of upcoming funds and payments

- Enterprise efficiency monitoring

The facility lies in the way it makes use of your precise enterprise information. It analyzes every little thing out of your invoices and payments to financial institution transactions to supply these insights. This implies you are getting predictions based mostly on what you are promoting’s actual patterns, not simply generic forecasts.

5. AI-powered assist

Xero’s integration of GenAI into their assist heart, Xero Central, has remodeled how customers discover solutions. As an alternative of scrolling via assist articles, now you can ask questions in plain language and get related solutions drawn from Xero’s assist documentation.

It could assist cut back common search time and reduce assist requests needing further assist. The very best half is that it provides customized responses based mostly in your function (enterprise proprietor, accountant, or bookkeeper and offers solutions generated from verified assist content material.

The system understands context and may piece collectively data from a number of assist articles to provide you complete solutions.

6. Xero Bills

Xero Bills makes use of AI to automate the expense administration workflow. It streamlines expense processing by scanning and studying receipts in real-time via your cellular digicam and extracting key information factors with excessive accuracy. It could detect merchandise descriptions and classes, buy quantities and currencies, tax calculations and elements, vendor data, and fee strategies.

It learns out of your expense patterns to counsel classifications, matching bills to financial institution transactions routinely. It could even create expense reviews based mostly in your custom-made guidelines.

Whereas Xero’s native AI options deal with many day-to-day duties successfully, some companies want extra superior automation for his or her accounting workflows. That is the place specialised AI instruments could make a major distinction.

[Image source: Xero’s official website]

The best way to develop Xero’s AI capabilities?

Xero provides a strong basis for digital accounting. It helps automate reconciliation, seize receipts, and streamline different on a regular basis finance duties. But when your workflow consists of excessive bill volumes, advanced approvals, or strict PO matching, there’s room to go even additional.

That’s the place Nanonets suits in. Nanonets connects on to your present Xero account. It does not disrupt your staff’s routine. You may preserve working in Xero as Nanonets quietly handles the heavy lifting within the background: automating doc consumption, information seize, approvals, and syncing every little thing again to Xero, totally mapped and able to go. It simply builds on Xero’s AI and automation capabilities with none added trouble.

This is how Nanonets enhances the accounts payable workflow. I may also share the implementation steps concerned in every stage.

1. Automate doc consumption

Uninterested in dragging recordsdata round or sorting via your inbox? With Nanonets, you possibly can have each bill, PO, or receipt despatched straight out of your finance mailbox, cloud drive, and even your vendor portal.

The AI additionally types the uploaded doc routinely. It sends invoices to the proper workflow, routing POs for matching, and eradicating junk or duplicates earlier than they ever hit your queue.

In case your invoices are in your e-mail, simply arrange e-mail auto-forwarding like within the video above. Nanonets’ classifier mannequin reads each doc and decides what’s price processing. No extra handbook sorting.

You don’t have to the touch each doc. The precise recordsdata go to the proper place, each time. You save hours and remove errors.

2. Superior information extraction with studying

Each bill is completely different, however that shouldn’t sluggish you down. Nanonets’ AI precisely extracts all the main points you want, be it your line objects, tax, vendor, GL codes. The system extracts 60+ fields and syncs with Xero in actual time.

Combine Nanonets together with your Xero occasion beforehand to make sure it routinely fetches or matches from the grasp information. If one thing’s lacking or mistaken, simply right it. The AI remembers, so subsequent time, it will get it proper.

In the long run, it reduces handbook entry and error charges, whereas the extraction retains bettering to suit your distinctive paperwork.

3. Automated PO matching and exception dealing with

PO matching is tedious, but it surely’s important for catching overbilling or errors. Nanonets automates this by pulling in your POs, matching them to invoices, and flagging any mismatches in value, amount, or description. You get a side-by-side view and may resolve points on the spot.

The AI matches POs and invoices, flags discrepancies, and brings exceptions to your consideration. You catch and resolve discrepancies early, so solely clear, correct information flows into Xero.

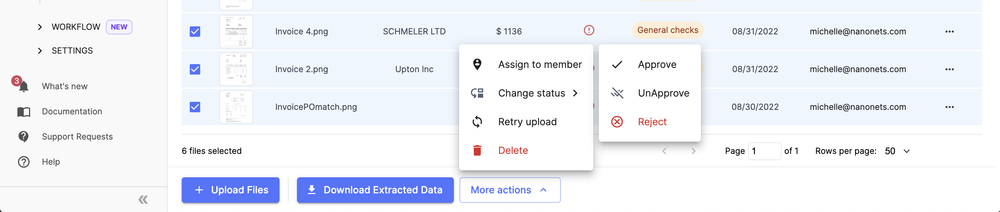

4. Configurable approval workflows

Approvals shouldn’t imply limitless e-mail chains or misplaced paperwork. Nanonets allows you to construct approval flows that match what you are promoting: route by quantity, division, or vendor, and ship notifications through Slack, Groups, or e-mail. Approvers get a direct hyperlink, can evaluate, approve, or remark, and every little thing is tracked.

Arrange guidelines for who must approve what. The system strikes recordsdata via every stage, notifies the proper individuals, and logs each motion. No extra bottlenecks or confusion. Approvals occur quick, with a transparent path for compliance.

5. Sync information to Xero

Re-entering authorised bill information into Xero doubles the work and introduces errors. Nanonets eliminates this step totally. Upon approval, all bill information—together with GL codes, tax data, and line objects—syncs on to Xero. The unique doc is hooked up for reference.

This automated workflow maintains information integrity between techniques and offers full documentation. Your books will keep present with out handbook information entry, and month-end closing turns into considerably quicker.

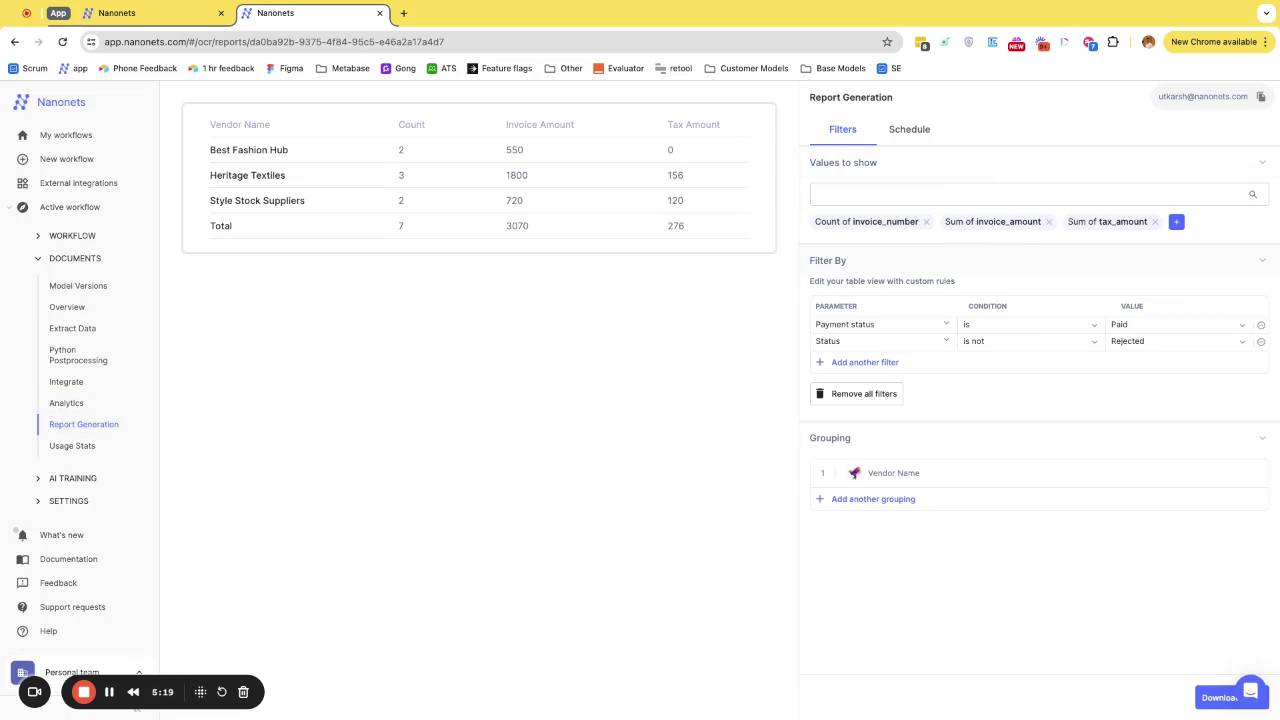

6. Actual-time reporting

Wish to know the place issues stand? Nanonets provides you dashboards and reviews on bill standing, bottlenecks, getting older, and even money move forecasts. Ask a query in plain English—like “present prime distributors by spend”—and get a solution, not only a spreadsheet.

The system aggregates all of your workflow information and provides you real-time analytics, together with pure language queries. You all the time know what’s taking place, can spot points early, and make smarter selections—with out ready for month-end.

Your entire cycle completes in beneath ~2 hours, in comparison with conventional 2-3 day processing occasions.

Closing ideas

Synthetic intelligence is reshaping accounting, and the mix of Xero’s native AI with Nanonets’ specialised automation creates a robust resolution for contemporary finance groups. This integration does not simply save time – it dramatically improves how your staff handles accounts payable, decreasing processing prices whereas bettering accuracy and management.

Able to see how AI can enhance your AP workflow? E-book a personalized demo to find out how Nanonets course of your precise invoices in real-time. Our staff will stroll you thru every step, from doc seize to Xero integration, utilizing your personal paperwork.